A profound transformation is reshaping the global artificial intelligence landscape as recent industry analyses reveal a striking trend: American startups and major tech leaders are increasingly turning to Chinese open-source large language models. This seismic shift marks a direct challenge to the long-standing dominance of Western proprietary systems, driven by a powerful combination of high performance, significantly lower costs, and the unparalleled flexibility of open-source licensing. The rapid ascent of Chinese AI, which has seen its share of global usage skyrocket from a mere 1.2% in late 2024 to nearly 30% in 2025, signals the emergence of a formidable competitor. While established Western systems like OpenAI’s GPT series still hold a majority market share, the collective usage of Chinese models now equals that of all other non-Chinese open-source alternatives combined, indicating that a new era of intense, two-superpower competition in AI has unequivocally begun.

The Economic and Practical Appeal of Chinese Models

The primary catalyst for this migration is a compelling economic and practical value proposition that is becoming increasingly difficult for developers and businesses to ignore. Chinese LLMs are demonstrating performance capabilities on par with their well-established Western counterparts but at a mere fraction of the operational cost. For instance, MiniMax’s M2 model provides a level of functionality comparable to that of Claude Sonnet 4.5 while costing only 8% of the price, a staggering difference that directly impacts the bottom line for startups and large enterprises alike. This cost efficiency allows for more extensive experimentation and deployment of AI technologies, democratizing access to cutting-edge tools. Highly competitive models such as Alibaba’s Qwen series, DeepSeek V3, and Moonshot AI’s Kimi K2 are rapidly gaining traction on global developer platforms like Hugging Face and OpenRouter, not just as cheaper alternatives but as powerful and reliable systems in their own right, accelerating their integration into the global tech ecosystem.

Beyond the significant cost savings, the allure of Chinese models is magnified by the strategic advantages offered by their open-weight licensing. This approach grants developers unprecedented freedom to access and modify the core model weights, enabling them to fine-tune the systems for specific tasks and build highly customized derivative models tailored to unique business needs. This level of flexibility stands in stark contrast to the often restrictive, closed-source nature of many leading U.S. systems. The innovative potential unlocked by this openness is best exemplified by Alibaba’s Qwen model, which has already spawned a vibrant ecosystem of over 170,000 derivative models. This trend has not gone unnoticed in Silicon Valley, where influential figures have publicly endorsed these new challengers. Airbnb CEO Brian Chesky praised Alibaba’s Qwen for being both “fast and cheap,” while prominent investor Chamath Palihapitiya noted his decision to move workflows to Moonshot’s Kimi K2 was based on its superior performance, signaling a broader industry acceptance of these powerful new tools.

Geopolitical Tensions and Strategic Advantages

The rapid and widespread adoption of Chinese artificial intelligence technologies has inevitably captured the attention of policymakers in Washington, igniting a complex debate surrounding national security and the potential erosion of long-held U.S. technological leadership. In response to these growing concerns, U.S. authorities have taken tangible steps, including placing several prominent Chinese AI firms on trade blacklists in an effort to curb their influence and slow their technological progress. However, these regulatory measures appear to be at odds with the pragmatic decisions being made in the global marketplace. A recent global survey of AI users and developers revealed a telling statistic: 82% of respondents indicated they would willingly adopt Chinese-developed models if they were hosted on servers outside of China. This finding suggests that for a vast majority of the global tech community, the immediate and tangible benefits of lower costs and superior performance currently outweigh the more abstract geopolitical anxieties and potential long-term security risks.

Underscoring this competitive dynamic is a formidable structural advantage that China possesses in its ability to build out the foundational infrastructure required for large-scale AI. This strategic edge was highlighted by Nvidia CEO Jensen Huang, who issued a stark warning about China’s capacity to construct AI infrastructure at an “unbelievable speed.” This rapid development is supported by two critical factors: an energy capacity that is reportedly double that of the United States and a massive, government-backed campaign of data-center construction. This ability to rapidly deploy the physical hardware and power resources necessary for training and running sophisticated AI models gives China a significant long-term advantage in the global AI race. The prevailing consensus among industry analysts is that this is not merely a fleeting trend but a fundamental rebalancing of power, establishing a new global order where China is cementing its position as a formidable and innovative peer to the United States.

A New Bipolar AI World Order Emerged

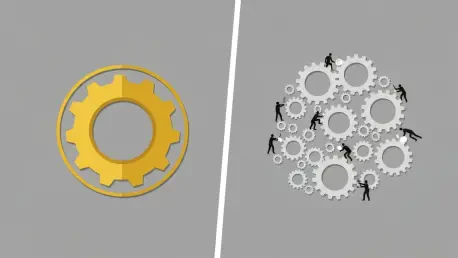

The confluence of economic incentives, technological parity, and strategic infrastructure investment has fundamentally altered the global AI hierarchy. What was once a field unequivocally led by American innovation has now evolved into a dynamic two-superpower race. The rapid adoption of Chinese LLMs by the global developer community, including within the U.S., demonstrated that market forces of price and performance could often supersede geopolitical alignments. The concerns raised in Washington and the regulatory actions that followed did not halt the momentum but rather highlighted the complexity of governing a deeply interconnected and rapidly evolving technological landscape. Ultimately, the events of the past year solidified the understanding that China had become not just a competitor but a co-leader in the artificial intelligence revolution, compelling a strategic reassessment for businesses and governments that had long operated under the assumption of Western technological supremacy.