The battlefield for software supply chain security has been dramatically redrawn by a single, decisive move from Docker, which has made its extensive catalog of over 1,000 hardened container images entirely free under an open-source license. This calculated disruption is aimed squarely at competitors, particularly Chainguard, the company widely credited with pioneering and defining the market for these security-focused images. By effectively commoditizing what was once a premium offering, Docker has ignited a high-stakes confrontation that not only challenges Chainguard’s business model but also forces the entire industry to reconsider the value and accessibility of foundational security tools. This strategic pivot transforms the competitive landscape from a straightforward product race into a complex chess match centered on platform dominance, value-added services, and fundamentally different security philosophies. The outcome will likely determine the future trajectory of DevSecOps and how organizations secure their cloud-native applications for years to come.

Docker’s Strategic Offensive

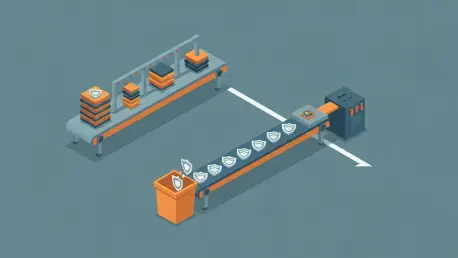

Docker’s aggressive maneuver is being positioned as a deliberate attempt to “force an industry security reset,” shifting hardened images from a paid add-on to a universally available baseline. The company left no ambiguity about its primary target, directly referencing a recent funding round for its competitor, Chainguard, in press materials discussing the new market pressures this move would create. This strategy is multifaceted, aiming to neutralize the threat from specialized vendors while simultaneously simplifying the security landscape for developers. Docker’s leadership has articulated that this initiative seeks to resolve market confusion stemming from a proliferation of security providers. The company’s core message is one of accessibility and ease of adoption; by building its hardened images upon familiar and widely used Linux distributions like Debian and Alpine, Docker claims to offer a frictionless path to enhanced security. This approach allows development teams to adopt more secure practices without disrupting their established workflows, thereby positioning Docker’s solution as a new de facto industry standard for secure, compatible base images.

This strategy is not merely about giving away a product for free; it is a calculated effort to leverage Docker’s immense platform scale to redefine the terms of competition. The company is banking on its established ecosystem and developer mindshare to drive widespread adoption of its free hardened images, effectively squeezing the market share of smaller, more focused players. By lowering the barrier to entry to zero, Docker encourages developers to experiment with and integrate its security offerings, creating a powerful gravitational pull toward its platform. This commoditization pressures competitors to justify their price points by offering value that extends far beyond the base image itself. The long-term goal appears to be the integration of security so deeply into the Docker platform that it becomes an inseparable part of the developer experience, making third-party alternatives seem less necessary. The early adoption by major enterprises like Adobe and Attentive signals that this strategy is already gaining traction, lending credibility to Docker’s vision of a security-centric, unified development environment.

The Battle of Philosophies and Business Models

The competitive clash quickly evolved beyond pricing into a public debate over fundamental security principles and business ethics. Docker executives launched a direct critique of Chainguard’s model, labeling its free tier—which predominantly offers only the most recent version of an image—as “the first anti-pattern in any secure deployment.” This criticism implies that forcing users onto the latest version is impractical for many production environments, which often require stable, long-term support for specific versions to maintain compatibility and reliability. Furthermore, Docker characterized a previous change in Chainguard’s free tier, which reduced the number of freely available images, as a “rug-pull,” thereby casting doubt on the stability and long-term viability of its competitor’s free offerings. This narrative aims to position Docker as the more stable and enterprise-ready partner for developers seeking a dependable security foundation without unexpected changes or limitations.

In a comprehensive rebuttal, Chainguard’s leadership met each of Docker’s criticisms head-on, articulating a starkly different vision for container security. Founder and CEO Dan Lorenc countered the “anti-pattern” claim by asserting that encouraging users to remain on the latest version is, in fact, a widely accepted “security best practice” designed to ensure that systems are protected by the most recent patches. He clarified that support for older image versions is a standard feature within Chainguard’s commercial offerings, addressing the need for long-term stability for paying customers. More pointedly, Lorenc highlighted a core philosophical divergence, arguing that Chainguard’s minimalist, “built-from-scratch” images are inherently more secure than Docker’s approach of hardening existing distributions by “mixing and matching components.” He concluded with a cautionary note, drawing a parallel between this new free offering and the history of Docker Desktop, which shifted from free to a paid subscription model, suggesting a potential “bait-and-switch” scenario could unfold once again.

Evolving Strategies in a New Market Reality

While making its base catalog of hardened images free, Docker simultaneously unveiled a sophisticated two-tiered commercial structure designed to monetize advanced features for enterprise customers. The first paid tier, Docker Hardened Images Enterprise, is tailored for corporate environments with stringent security and compliance needs. This offering includes a formal service-level agreement (SLA) that guarantees remediation of critical vulnerabilities within seven days, with a stated goal of achieving same-day fixes in the future. Crucially, this tier also provides images that are pre-certified for various industry and government standards, such as FIPS, STIG, and PCI DSS, removing a significant compliance burden for organizations in regulated sectors. This freemium model allows Docker to capture a broad user base with its free offering while generating substantial revenue from enterprises that require official support, compliance assurance, and guaranteed response times for security incidents.

In a clear sign that it is not merely reacting to market pressures, Chainguard announced a strategic expansion of its own with the launch of a new service named EmeritOSS. This initiative signals a deliberate move to diversify its business beyond its core image-hardening products. EmeritOSS is designed to provide a secure and professionally maintained home for mature or even deprecated open-source projects that are still critical components in many organizations’ technology stacks. The program launched by taking stewardship of three key projects: Kaniko, Kubeapps, and the deprecated ingress-nginx controller. While the source code for these maintained forks will be freely available on GitHub, Chainguard will offer continuous maintenance and support as a commercial service. This proactive move allows Chainguard to carve out a new market niche, addressing a persistent pain point for enterprises reliant on legacy open-source tools, and demonstrates its ambition to be a comprehensive software supply chain security partner.

A Redefined Battlefield

The strategic confrontation initiated by Docker ultimately redefined the competitive dynamics of the software supply chain security market. The commoditization of basic hardened images shifted the focus away from the images themselves and toward the value-added services built around them. This forced all players, including both the incumbent platform giant and the specialized challenger, to innovate and articulate a clearer value proposition beyond simple vulnerability scanning. For end-users, this intensified competition resulted in greater access to foundational security tools at a lower cost, while also presenting a clearer choice between integrated platform solutions and best-of-breed specialized services. The conflict underscored two distinct philosophies: one prioritizing seamless integration and compatibility, and another championing minimalist, security-first design. In the end, this clash did not produce a single victor but rather catalyzed a market maturation, compelling vendors to deliver more sophisticated solutions that addressed enterprise needs for compliance, long-term support, and the security of the entire open-source ecosystem.