An unprecedented surge in demand for electricity, substantial enough to power every household across the state of California, is currently challenging the state’s energy infrastructure, yet this colossal need is not for its residents. Instead, it stems from the voracious appetite of data centers, the computational hearts of the artificial intelligence revolution. As these massive facilities proliferate, they are placing an extraordinary strain on public power grids, igniting a fierce debate in the nation’s technology capital. The central conflict revolves around a critical question of financial responsibility: When the insatiable energy consumption of multi-trillion-dollar technology corporations necessitates costly and extensive upgrades to public utilities, should the financial burden fall upon the companies driving the demand, or should it be distributed among everyday residential and small business consumers through increased electricity rates? This question has become the focal point of a major legislative battle, pitting the future of technological growth against the principles of equitable cost allocation and environmental stewardship.

A Legislative Showdown over Power and Costs

In a proactive move to address the escalating energy dilemma, California lawmakers initially advanced a comprehensive and ambitious legislative proposal designed to hold the technology industry directly accountable for its immense power consumption. The cornerstone of this effort was a bill that sought to create an entirely separate and dedicated electricity rate class for data centers. This provision was engineered to ensure that the significant costs associated with meeting their high energy demand would be borne by the industry itself, thereby insulating other ratepayers from financial impact. The legislation also included forward-thinking mandates that would have required these facilities to install their own large-scale battery storage systems to help stabilize the grid during peak hours and to source one hundred percent of their power from carbon-free energy by 2030, a timeline significantly more aggressive than the state’s overarching clean energy goals. This robust framework was intended to align the industry’s rapid expansion with California’s climate objectives and protect consumers.

However, this bold regulatory push was met with a swift, powerful, and highly organized opposition that effectively dismantled the legislation piece by piece. A coordinated lobbying campaign, spearheaded by Big Tech companies, influential industry associations, and various business groups, systematically targeted the bill’s core provisions. Their influence extended to the highest levels of state government, creating a unified front against the proposed regulations. Under intense pressure, lawmakers stripped away the requirement for a separate electricity rate, eliminated the mandate for on-site battery storage, and removed the accelerated clean energy timeline. What began as a comprehensive attempt to manage the environmental and economic impacts of the data center boom was methodically weakened, transforming a potentially transformative piece of legislation into a shadow of its original intent and signaling a major victory for industry interests over regulatory oversight.

The Economic Stakes and Unprecedented Demand

The primary argument wielded by the technology industry and its allies centered on the concept of economic competitiveness. Industry leaders issued stark warnings that imposing stringent energy regulations would tarnish California’s reputation as a favorable location for investment, prompting developers to relocate their multi-billion-dollar projects to other states with more lenient regulatory environments, such as Texas. They argued that such an exodus would result in the loss of thousands of high-paying union construction jobs, a significant reduction in valuable property-tax revenue, and a “brain drain” of critical AI talent. This narrative was potent enough to influence the governor’s office, which expressed deep concerns that introducing new, unilateral requirements on the industry without a complete understanding of the economic consequences could jeopardize the state’s leadership position in the global AI race. The governor’s veto of a separate, more modest bill requiring data centers to report their water usage further underscored this reluctance to impose new oversight.

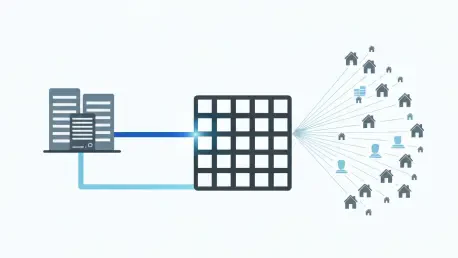

Fueling the urgency behind this legislative conflict is the staggering scale of the energy demand from the burgeoning data center sector. According to the California Energy Commission, developers have formally requested an astounding 18.7 gigawatts of new service capacity from utility providers, all earmarked specifically for data center operations. This figure is not just large; it is monumental, representing more electricity than is required to power every single household in the entire state of California combined. This massive, concentrated load presents a formidable challenge to the state’s electrical grid, which was not designed to accommodate such rapid and intensive growth. Consequently, it raises fundamental questions about the necessity of extensive and costly infrastructure upgrades and, more critically, who should ultimately bear the financial burden for modernizing the grid to support the industry’s explosive expansion, a cost that could easily run into the billions of dollars.

A Diluted Outcome and Challenging the Narrative

Following the intense and successful lobbying campaign, the legislative session concluded with a dramatically weakened outcome. The only surviving measure from the original, robust package was a bill mandating that the California Public Utilities Commission (CPUC) conduct a study to analyze the cost impacts of data centers on the state’s power grid. However, the final report from this study is not due until 2027, a deadline that effectively postpones any potential for informed and meaningful regulatory action. Critics have widely condemned this result as a “toothless” and largely symbolic gesture, representing a significant strategic victory for the tech industry. It allows for several more years of unchecked growth and mounting pressure on the energy grid while delaying any substantive policy decisions. Furthermore, experts point out that the CPUC already possesses the authority to conduct such investigations, making the new law a redundant measure that does little more than affirm an existing capability.

Despite the industry’s successful campaign, several experts are beginning to question the validity of its central arguments. The assertion that businesses will flee California in response to regulation is a long-standing tactic employed across various sectors, yet it often fails to materialize, as the state consistently maintains its position as one of the world’s largest and most dynamic economies. More specifically, the claim that regulating data center infrastructure would cause an exodus of AI talent is being challenged by researchers. Shaolei Ren, an AI researcher at UC Riverside, argues that the physical location of a massive data center is largely “decoupled” from where top researchers and developers choose to live and work. The primary factors driving data center siting—cheap land, low energy prices, and streamlined permitting—are fundamentally different from the quality-of-life and ecosystem factors that attract highly skilled professionals, undermining the industry’s “brain drain” narrative.

A New Bargaining Chip for Future Negotiations

This emerging counter-narrative introduces a nuanced perspective that could reshape future legislative efforts. Matthew Freedman of The Utility Reform Network (TURN) suggests that the very fact that developers are proposing massive new facilities in a state known for its high electricity rates indicates that energy cost may not be their primary deterrent. Instead, their chief concern is often the speed and certainty of the permitting and approval process. This dynamic could provide lawmakers with a powerful new bargaining chip. The state could potentially offer a streamlined, expedited approval process—a highly valuable commodity for multi-billion-dollar projects on tight timelines—in exchange for developers agreeing to cover a larger, more equitable share of the grid upgrade costs their projects necessitate. Such a compromise would protect residential and small business customers from significant rate hikes while still allowing the industry to expand. For these corporations, even large energy bills can be akin to “rounding errors,” making them potentially willing to pay more to avoid costly regulatory delays.

The 2024 legislative session ultimately saw the powerful influence of the technology industry preempt California’s first significant push to regulate the environmental and economic impacts of data centers. A comprehensive, multi-pronged legislative effort was systematically reduced to a single, delayed study, marking a clear win for corporate interests. However, the underlying debate over resources, costs, and regulatory oversight was far from resolved. Lawmakers signaled their intent to revisit the issue, with plans to introduce new bills focused on how long-term grid infrastructure costs are allocated and to reintroduce stalled legislation requiring data centers to disclose their electricity usage. While the industry won the initial battle, the conflict had set the stage for future confrontations. The mandated 2027 report, though currently viewed as a weak outcome, could eventually provide the critical data and framework needed to shape these subsequent legislative debates, ensuring that the question of who pays for Big Tech’s power would remain a central theme in California’s political and energy landscape.