In the ever-evolving landscape of the Lloyd’s insurance market, accurately assessing performance amid fluctuating market cycles has long been a formidable challenge for syndicates, managing agents, and investors alike, who often struggle with inadequate traditional metrics. These metrics frequently fail to capture the nuances of market conditions, leaving stakeholders grappling with skewed perceptions of success or failure. Enter Insurance Capital Markets Research (ICMR), an independent analytics and research firm founded by seasoned experts from Lloyd’s internal performance team. This innovative firm is redefining how performance is evaluated through a groundbreaking combination of relative benchmarking and predictive artificial intelligence (AI). By shifting the focus from absolute figures to comparative insights and forward-looking data, ICMR is empowering the market to identify true outperformers and build more resilient portfolios. This transformation promises to address long-standing gaps in underwriting analysis, offering a clearer path to sustained success in a complex industry.

Rethinking Performance Metrics

The Lloyd’s market, with its intricate structure and sensitivity to economic cycles, has historically struggled to measure performance effectively using absolute metrics alone. These traditional figures often paint a distorted picture, inflating results during soft market periods when conditions are favorable, or unfairly penalizing well-managed syndicates during tougher phases. Such inconsistencies make it nearly impossible to distinguish genuine underwriting excellence from outcomes driven by external factors. ICMR challenges this outdated approach by advocating for relative benchmarking, a method that evaluates syndicates against their peers rather than in isolation. Historical data analyzed by the firm reveals a striking trend: syndicates tend to maintain consistent relative rankings over time. This suggests that performance is rooted in enduring strengths, such as strategic decision-making or operational efficiency, rather than temporary market winds, providing a more reliable gauge of quality.

Beyond the limitations of absolute metrics, relative benchmarking offers a nuanced lens through which stakeholders can uncover hidden insights. By directly comparing syndicates within the same market context, this approach filters out the noise of cyclical fluctuations and highlights those consistently outperforming their competitors. ICMR’s research underscores that true outperformers are not just those posting high numbers in favorable times, but entities demonstrating resilience and adaptability across varying conditions. This shift in perspective is critical for managing agents and investors seeking to allocate capital wisely. With relative benchmarking, decisions become less about chasing short-term gains and more about recognizing sustainable value. As a result, the methodology fosters a deeper understanding of competitive positioning, enabling stakeholders to prioritize long-term stability over fleeting market-driven results in the Lloyd’s ecosystem.

Harnessing Predictive AI for Future Insights

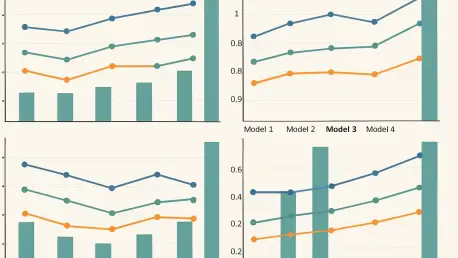

A cornerstone of ICMR’s transformative approach lies in its integration of predictive AI, which elevates relative benchmarking to new heights of precision. Leveraging advancements in probabilistic programming and access to granular performance data, the firm has developed a sophisticated AI-driven Bayesian model, drawing inspiration from ranking frameworks like the Plackett-Luce model. This cutting-edge tool forecasts relative loss ratio performance across diverse business classes, offering a forward-looking perspective on profitability and stability. Unlike static historical analyses, these predictions provide actionable insights into which syndicates are poised for consistent success and which face risks of volatility. By pairing this technology with broader market forecasts, ICMR equips stakeholders with a comprehensive view of potential outcomes, enhancing decision-making in underwriting and portfolio management.

The practical impact of predictive AI extends far beyond theoretical innovation, delivering tangible benefits to those navigating the Lloyd’s market. Portfolios constructed using ICMR’s combined approach of relative benchmarking and AI-driven insights consistently show higher expected returns and reduced volatility compared to those built on traditional benchmarks. A compelling case study from a collaborative white paper illustrates this value: a syndicate’s management team utilized ICMR’s analysis to refine their portfolio quality incrementally each year, achieving measurable performance improvements. This example highlights how predictive tools can translate complex data into strategic actions, enabling syndicates to anticipate challenges and capitalize on opportunities. As AI technology continues to evolve, its role in providing clarity amid market uncertainty becomes increasingly indispensable for informed, future-focused planning.

Driving Sustainable Success in a Complex Market

The adoption of relative benchmarking and predictive AI signals a broader shift in how performance is understood and managed within the Lloyd’s market, addressing the inherent complexities of its cyclical nature. ICMR’s methodology moves beyond the shortcomings of outdated metrics, offering a stable and revealing measure of underwriting quality that accounts for peer performance and market dynamics. This approach empowers syndicates and investors to pinpoint genuine outperformers—those entities demonstrating consistent excellence regardless of external conditions. By providing a data-driven framework, ICMR helps stakeholders navigate the intricacies of market cycles with greater confidence, ensuring that decisions are grounded in evidence rather than speculation. The result is a more robust foundation for achieving long-term competitive advantage in an industry often defined by unpredictability.

Looking back, ICMR’s contributions marked a pivotal moment for the Lloyd’s market, as the firm’s innovative tools redefined the standards of performance evaluation. The integration of relative benchmarking with AI-driven insights proved to be a game-changer, offering clarity where traditional methods fell short. For syndicates and investors moving forward, the next steps involve embracing these methodologies to refine portfolio strategies and enhance risk management. Exploring partnerships with analytics firms like ICMR could further unlock customized solutions tailored to specific business needs. Additionally, staying abreast of advancements in AI technology promises to keep stakeholders ahead of emerging trends. Ultimately, the focus shifts to building a culture of continuous improvement, where data and innovation drive decisions, ensuring sustained success in an ever-shifting landscape.