Imagine a world where a single underwater snag can slow down global business operations, costing millions in mere hours, as happened on September 6, 2025, when undersea cable cuts in the Red Sea disrupted connectivity for major cloud services like Microsoft Azure. This event impacted users across Asia and the Middle East, exposing a critical vulnerability in the digital economy, where latency spikes can derail real-time operations for industries reliant on instantaneous data exchange. This market analysis dives into the implications of such events on cloud services and enterprises, exploring current trends, financial impacts, and future projections for global internet infrastructure. The urgency to address these challenges is paramount as businesses and providers grapple with the ripple effects of a fragile connectivity backbone.

Dissecting Market Trends and Data Disruptions

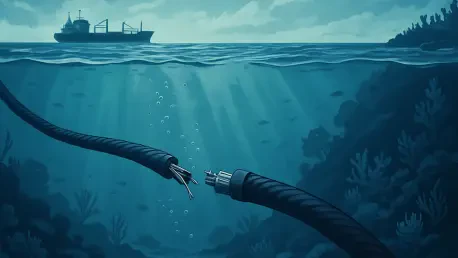

Undersea Cables: The Vulnerable Core of Connectivity

Undersea cables, often unseen yet indispensable, carry over 95% of international data traffic, forming the lifeline of global internet connectivity. The Red Sea, a pivotal chokepoint, channels roughly 17% of this traffic, linking Asia with Western markets through critical pathways. Recent disruptions near Jeddah, Saudi Arabia, affecting cables like SMW4 and IMEWE, have led to significant latency issues for platforms such as Azure. Reports from internet monitoring groups highlight connectivity degradation in nations like the UAE and Pakistan, painting a stark picture of dependency on a handful of submarine routes. This incident underscores a persistent trend: localized damage in high-traffic zones can trigger widespread digital slowdowns, challenging the stability of cloud-reliant markets.

Latency’s Toll on Cloud-Dependent Industries

The immediate aftermath of the Red Sea cable cuts revealed sharp latency spikes, with cloud providers noting rerouted traffic through suboptimal paths causing delays in data centers across India and the Middle East. Industries such as e-commerce, logistics, and financial trading, which depend on real-time applications like APIs and video conferencing, faced operational hiccups. Market data suggests that even a few milliseconds of delay can disrupt high-frequency trading platforms or e-commerce checkout processes, leading to measurable revenue drops. This trend of operational vulnerability signals a growing risk for sectors embedded in cloud ecosystems, where seamless performance is non-negotiable for competitive edge.

Financial Fallout and Rising Costs

Beyond technical delays, the financial burden of these disruptions is substantial for both enterprises and cloud providers. Businesses encounter direct losses from interrupted services, unmet service level agreements, and declining customer trust due to sluggish performance. Cloud providers, meanwhile, absorb higher operational expenses as they secure alternative routing paths to mitigate impact. Industry estimates point to multimillion-dollar repair costs for damaged cables, alongside escalating insurance premiums for infrastructure in geopolitically sensitive regions like the Red Sea. These economic pressures highlight a market trend of hidden costs that could reshape budgeting strategies for digital infrastructure over the next few years.

Projections: Navigating Toward Resilience

Evolving Strategies for Infrastructure Stability

Looking ahead, market projections from 2025 to 2027 anticipate a shift toward diversified traffic routing to reduce reliance on singular undersea pathways. Analysts expect increased investment in physical diversity—spreading data across multiple geographic routes—rather than depending solely on logical redundancy within existing systems. Emerging technologies, such as satellite backups and terrestrial fiber networks, are poised to gain traction as complementary solutions. This trend reflects a broader industry push to future-proof connectivity against recurring disruptions in critical zones, potentially stabilizing cloud service delivery for high-stakes markets.

Geopolitical Risks Shaping Market Dynamics

The Red Sea’s strategic importance is matched by its volatility, with geopolitical tensions adding layers of uncertainty to digital infrastructure forecasts. Unconfirmed reports of regional conflicts contributing to the recent cable cuts emphasize the intersection of politics and technology markets. Projections suggest that such risks will drive regulatory scrutiny, with governments likely to mandate stricter contingency frameworks for cloud providers operating in vulnerable areas. This evolving landscape could reshape market strategies, as companies may need to allocate resources for geopolitical risk assessments alongside traditional network planning.

Technological Innovations as Market Catalysts

Technological advancements are expected to play a pivotal role in mitigating latency risks over the coming years. AI-driven network monitoring tools are forecasted to become integral, enabling predictive analytics to preempt disruptions before they escalate. Market trends also point to growing adoption of decentralized network architectures, which distribute data loads more evenly and reduce the impact of localized failures. These innovations could redefine competitive dynamics in the cloud services sector, rewarding providers who prioritize adaptability and proactive resilience in their offerings.

Reflecting on Insights and Charting the Next Steps

The market analysis of the Red Sea cable cuts in 2025 revealed a profound vulnerability in global connectivity, with latency challenges impacting cloud giants like Azure and enterprises across key regions. The financial strain, compounded by operational setbacks and geopolitical uncertainties, painted a complex picture of risk for digital markets. These disruptions served as a critical reminder of the concentrated nature of internet traffic through undersea cables and the cascading effects of even temporary outages. Moving forward, businesses must pivot to actionable strategies, such as integrating satellite backups and demanding transparency from providers on routing vulnerabilities. Collaborative efforts between enterprises and cloud providers to simulate outages and refine contingency plans emerged as essential steps to safeguard against future shocks. Ultimately, this event catalyzed a renewed focus on building a resilient digital ecosystem, urging stakeholders to invest in diversified infrastructure and innovative tools to secure market stability.